*KellyV

Consistently top ranked KellyV, is a short term, auto-ex, artificial intelligence (AI) algorithm, trading RBOB Gasoline Futures contracts on the NY Mercantile Exchange (NYMEX). It has a nice consistent equity curve and the system requires minimal input or monitoring. What makes KellyV unique, is that it is composed of three separate but integrated subsystems – Dual Micro Cycle, ATR Trend & ATR Counter Trend.

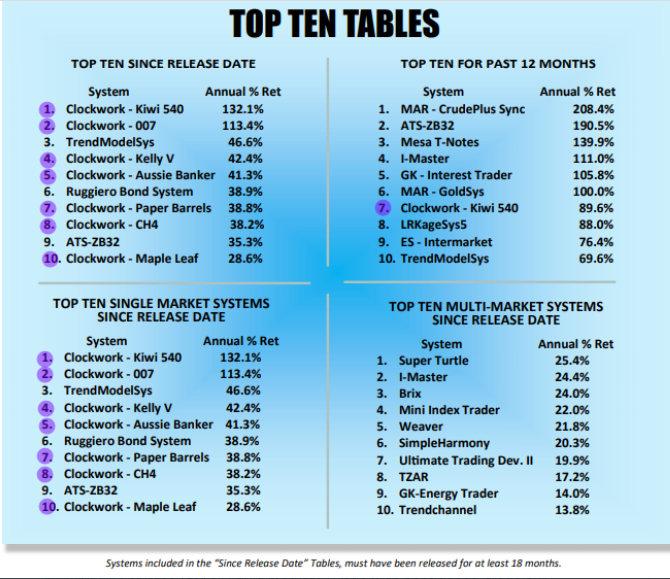

*Consistently Top Ranked System by Futures Truth Magazine

* Paper Barrels, America’s Top Rated Crude Oil System

Paper Barrels, is an auto-ex, artificial intelligence (AI) algorithm, trading Crude Oil futures on the NY Mercantile Exchange (NYMEX), London’s International Petroleum Exchange (IPE) and/or the Dubai Mercantile Exchange (DME). It has a nice consistent equity curve and the system requires minimal input or monitoring. The system enforces a strict percentage and volatility based money management mechanism and can be customized to alert end users via text or SMS message.

daVinci

daVinci multi-market, is a hands free, short term, mean reversion, mechanical day trading system, recommended for intra-day trading the worlds most liquid traded markets such as Cryptocurrencies, US Equities, Forex (FX) & Futures. daVinci continually re-calibrates recent market data and sets-up trades with predetermined buy, sell, stop-loss and exit targets. The strategy adheres to a strict percentage based money management technique and can be customized to alert end users via text or SMS message.

BTC.252

BTC.252, is an auto-ex, artificial intelligence (AI) algorithm, trading Bitcoin futures on the Chicago Mercantile Exchange (CME) and the Bakkt BTC (USD) monthly futures contract traded on the Intercontinental Exchange (ICE). It has a nice consistent equity curve and the system requires minimal input or monitoring. The system enforces a strict percentage and volatility based money management mechanism and can be customized to alert end users via text or SMS message.

Sniper.GBTC

Sniper GBTC, was designed to trade the popular Grayscale Bitcoin Trust (BTC). The Trust’s purpose is to hold Bitcoins, which are digital assets that are created and transmitted through the operations of the peer-to-peer Bitcoin Network, a decentralized network of computers that operates on cryptographic protocols. It has a nice consistent equity curve and the system requires minimal input or monitoring. The system enforces a strict percentage and volatility based money management mechanism and can be customized to alert end users via text or SMS message.

–

Symphony.V

Preferred Portfolio Series

Symphony, are our proprietary, micro seasonal mapped, artificial intelligence (AI) algorithmic portfolios, each consisting of five (5) low-correlated, diversified, sub-systems, trading one (1) contract from each market sector, Agriculture, Currency, Petroleum, Financial Index and Precious Metal on key proprietary timestamps.

Symphony.V Futures Portfolio A – Sundial (Soybeans), Rising Sun (Japanese Yen) *CH4 (Natural Gas), NASQAR100 (NASDAQ100 Index) & Plata, (Silver).

Symphony.V Futures Portfolio B – JuaVa (Coffee), *Aussie Banker (Australian Dollar), *Paper Barrels (Crude Oil), *Spyglass (S&P 500 Index) & *MetalBank.AU (Gold).

Symphony.V Futures Portfolio C – *#i-Sugar, (Sugar #11), *Mapleleaf (Canadian Dollar), *KellyV (RBOB Gasoline), *30 Wall St. (Dow Jones Index) & Atomic #78, (Platinum).

Symphony.VI ETF Portfolio – #Sniper.GBTC, Grayscale Bitcoin Trust BTC (Bitcoin), #Mapleleaf, Invesco Currency Shares Canadian $ (Canadian Dollar), #Sniper.UGA, United States Gasoline Fund LP (Gasoline), #Sniper.SPY, SPDR S&P 500 ETF (S&P 500 Index), #Sniper.GLD, SPDR Gold Trust (Gold) & #Sniper.VIX, (iPath Series B S&P 500 VIX Short Term)

Symphony.XI US Securities Portfolio – American Tower, Cisco Systems, Chevron Corp., DuPont, Duke Energy, Goldman-Sachs Group, Johnson & Johnson, Lululemon Athletica Inc., Netflix Inc., Procter & Gamble & Southwest Airlines.

* Independently Top Rated Trading Systems by Futures Truth Magazine, Various Issues 2011-2021

Futures trading is not appropriate for all traders. There is a substantial risk of loss associated with trading these markets. Losses can and will occur. No system or methodology has ever been developed that can ensure returns or prevent losses. No representation or implication is being made that using the systems described in this document will generate returns or ensure against losses.

Forex trading is not appropriate for all traders. There is a substantial risk of loss associated with trading these markets. Losses can and will occur. No system or methodology has ever been developed that can ensure returns or prevent losses. No representation or implication is being made that using the systems described in this document will generate returns or ensure against losses. We do not and cannot give individual investment advice. We do not and cannot manage funds.

U.S. Government Required Disclaimer – Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.